BRT-Tax Crafter (BTC)

Indirect Tax Compliance (ITC)

What is Indirect Tax Compliance?

- Indirect taxes in the UK and Europe primarily consist of Value Added Tax (VAT) and excise duties on specific goods such as alcohol, tobacco, and energy.

- The common VAT system applies to goods and services bought and sold for use or consumption within the EU.

- Excise duties are levied on the sale or use of certain products.

- VAT harmonization in the EU aims to ensure transparency in intra-EU trade and the proper functioning of the internal market.

- In the UK, the indirect tax system includes rules that businesses must be aware of, such as registration limits for VAT and specific legislation for non-resident supplies of electronically supplied services.

Solution Offerings

The Solution offers various levels and benefits to supercharge businesses. Let me break it down for you:

Business Benefits

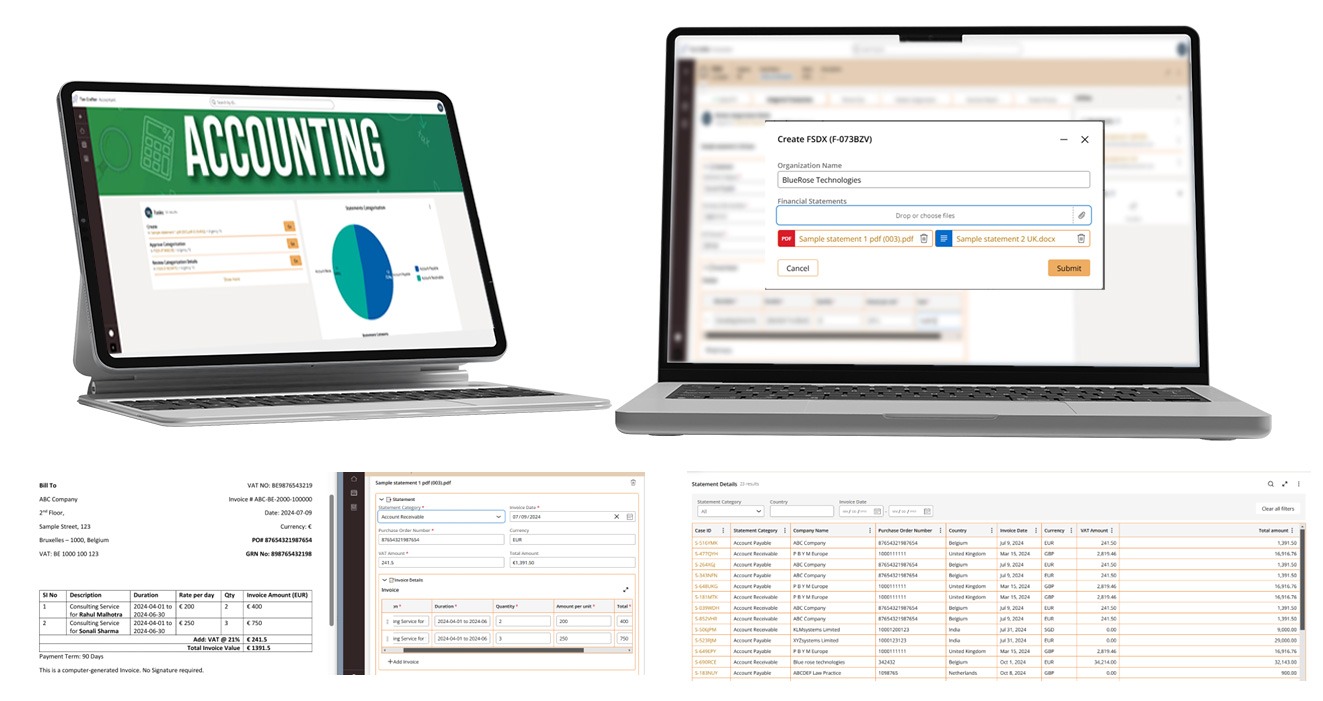

Application Snapshots